[:en]

Introduction

Many people purchase insurance policies during their lifetime but are uncertain about the details in the thick set of papers they are given. In our previous article, we sought to demystify nominations for insurance policies, namely trust nominations and revocable nominations. In this article, we seek to answer 5 common questions in relation to estate planning and insurance policies.

Question 1:

How does writing a Will complement my financial portfolio when I already have insurance policies?

A Will would cover all of your assets in Singapore, including money in your bank accounts, immovable properties, stocks, shares as well as insurance policies.

If you do not make any nomination for your insurance policies and you do not have a Will, all the proceeds from your insurance policies will be distributed according to the rules under the Intestate Succession Act[1].

If you do not make any nomination for your insurance policies and you have a Will, all the proceeds from your insurance policies will be distributed according to your Will.

To ensure that your assets go to your intended beneficiaries, estate planning is very important.

Question 2:

What happens when I make a revocable nomination for my insurance policy in 2017, followed by a Will in 2018? Will my 2018 Will supersede my 2017 nomination?

Yes, the insurance nomination made in 2017 will be revoked by the Will made in 2018, but only if these two conditions are fulfilled:

- The Will provides for the disposition of all death benefits under the relevant policy[2]; and

- The Will specifies such particulars of the relevant policy[3]:

a. the name of the licensed insurer that issued the relevant policy;

b. the policy number;

c. the name of each beneficiary under the relevant policy;

d. if the beneficiary is a person:

i. his NRIC number or Singapore Birth Certificate Number or Foreign Passport number and the country which issued his passport (if he is not a Singapore Citizen or Permanent Resident)

ii. his address; and

iii. his date of birth;

e. if the beneficiary is not a person (for example, a company or a charity):

i. the Singapore Unique Entity Number of the beneficiary or any other official registration number which identifies and is unique to the entity if there is no Unique Entity Number; and

ii. the address of the beneficiary; and

f. the portion of the death benefits under the relevant policy which is given to each beneficiary.

Question 3:

Will my proceeds be immediately protected from creditors if I make a nomination under my insurance policy?

It depends on the type of nomination made. If you make a trust nomination[4], the insured sum does not form part of your estate as the policy owner. Thus, creditors are not allowed to access these policy proceeds as they are considered trust assets protected by trust law in Singapore.

However, if you make a Revocable Nomination[5], the insured sum is not covered by trust law and is not protected from creditors.

Question 4:

What happens if both the policy owner and the nominee of the revocable nomination pass away at the same time?

It is uncommon for two people to pass away at exactly the same time. If it can be determined that one person passed away before the other, it makes a difference to who gets the proceeds.

However, there can be situations, such as an unfortunate plane crash, where the circumstances makes it difficult to determine who passed away first. In such a situation, there is a presumption of survivorship that applies[6]. In the absence of any order of court determining otherwise, the deaths will be presumed to have occurred in order of seniority and the younger shall be deemed to have survived the older.

If the policy owner passes away first, the nomination is still valid. The proceeds will go to the nominee(s).

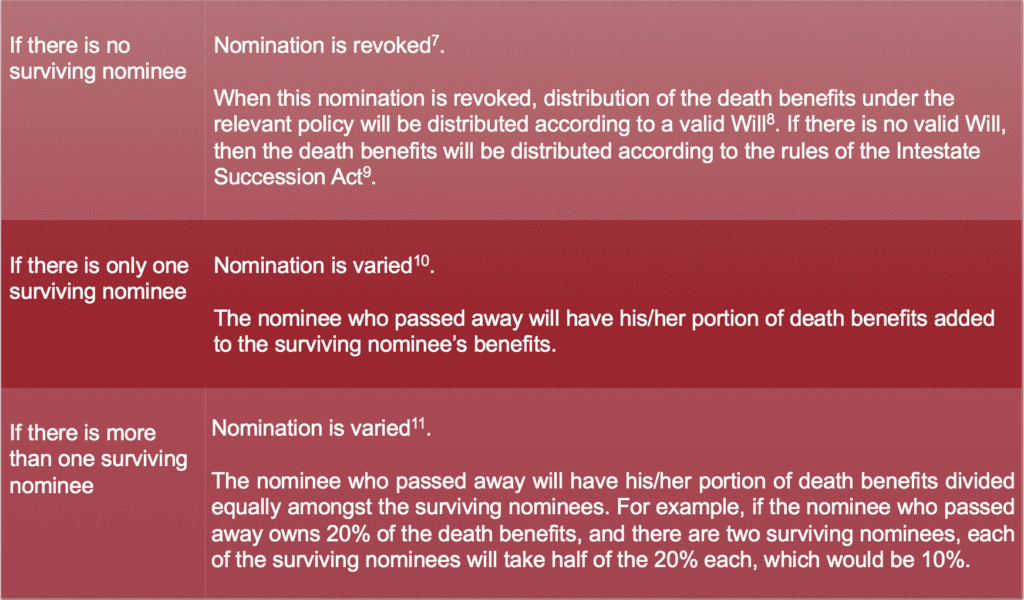

If the nominee passes away first, then what happens to the proceeds depends on the number of surviving nominees. The table below explains the different scenarios based on the number of surviving nominees.

Question 5:

What happens if I pass away and my nominees are below the age of 18?

A licensed insurer may make a payment under a revocable nomination for death benefits if[12]:

- You have made a nomination in respect of the policy;

- The licensed insurer received written notice of this nomination; and

- The nomination is not revoked.

A licensed insurer can make payment to the following people (without the production of any Grant of Probate or Grant of Letters of Administration)[13]:

- Trustee[14]

If there is any trustee of the policy monies, payment can be made to that trustee for the benefit of every nominee or if there is more than one such trustee, to any such trustee.

- Nominee, parent/legal guardian of Nominee or personal representative of estate of nominee[15]

Payment can be made directly to:

- any nominee under that nomination who is 18 years old and above;

- a parent or legal guardian (who is not the policy owner) of any nominee who is below the age of 18 years; or

- the personal representatives of the estateof any nominee under that nomination who is deceased.

- Executor[16]

If there is a Will, payment may be made to the executor of the Will if the following conditions are met:

- There is a valid Will made by the policy owner;

- The Will provides for the disposition of all death benefits under the relevant policy;

- The Will specifies such particulars of the relevant policy (see Question 2); and

- The licensed insurer of the policy has received written notice, signed by the policy owner, of that Will.

[1] Cap. 146

[2] s 49M(7)(b)(i)) of the Insurance Act (Cap. 142)

[3] s 49M(7)(b)(ii) of the Insurance Act read with regulation 5 of the Insurance (Nomination of Beneficiaries) Regulations 2009

[4] S 49L of the Insurance Act

[5] S 49M of the Insurance Act

[6] S 49M(6) of the Insurance Act

[7] S 49M(5)(a)) of the Insurance Act

[8] S 49M(8)(b) of the Insurance Act

[9] S 49M(8)(c) or s 49M(9)(b) of the Insurance Act

[10] S 49M(5)(b)) of the Insurance Act

[11] S 49M(5)(c)) of the Insurance Act

[12] S 61(7) of the Insurance Act

[13] S 61(2)(a) of the Insurance Act

[14] S 61(7)(i) of the Insurance Act

[15] S 61(7)(ii) of the Insurance Act

[16] S 61(9) of the Insurance Act

Download article here.[:]